this Foxconn Industrial Internet Co., Ltd. (Shanghai Stock Exchange: 601138) The stock price has performed very well in the past month, rising as much as 26%. Looking back further, the stock is up 89% in the last year, which is encouraging.

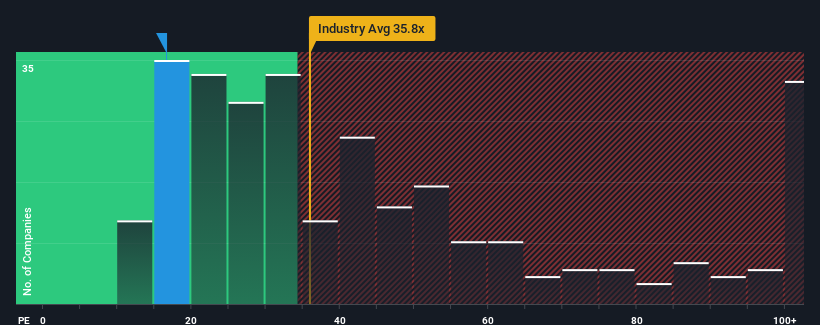

Despite the stock price surge, Foxconn Industrial Internet’s price-to-earnings ratio (or “P/E”) of 16.6 times may still make it look like a buy compared to the Chinese market, where about half of the companies have P/E ratios of more than 30 times or even P/E ratios More than 53 times is also common. Still, it’s not wise to just take the P/E ratio at face value, as there may be an explanation for why it’s limited.

Foxconn Industrial Internet has been doing really well lately, with its earnings growing well while most other companies’ earnings are going backwards. One possibility is that the P/E ratio is low because investors believe the company’s earnings will soon decline like those of other companies. If you like the company, you’ll wish that wasn’t the case so you could potentially buy some shares if it falls out of favor.

See our latest analysis for Foxconn Industrial Internet

Eager to know how analysts view the future of Foxconn Industrial Internet and competition in the industry?In this case, our free Reports are a great place to start.

Is growth consistent with low P/E ratios?

There is an inherent assumption that a company’s P/E ratio should be lower than the market, such as Foxconn Industrial Internet’s P/E ratio to be considered reasonable.

First, taking a look back, we see that the company comfortably grew its earnings per share by 5.9% last year. Earnings per share are also up 28% from a total of three years ago, thanks in part to growth in the last 12 months. So it’s fair to say that the company’s recent earnings growth has been impressive.

Looking ahead, analysts covering the company expect earnings to grow 10.0% annually over the next three years. With the market expected to grow at 22% annually, the company’s earnings results are expected to be weaker.

With this information, we can see why Foxconn Industrial Internet’s P/E ratio is lower than the market. It seems that most investors expect limited future growth and are only willing to reduce the amount of shares they purchase.

What can we learn from Foxconn Industrial Internet’s P/E ratio?

The latest share price gains aren’t enough to bring Foxconn Industrial Internet’s P/E ratio close to the market median. Generally speaking, we tend to limit the use of the P/E ratio to determine the market’s perception of a company’s overall health.

As we suspected, our review of Foxconn Industrial Internet analyst forecasts shows that its poorer earnings outlook contributes to its low P/E ratio. For now, shareholders are accepting low P/E ratios as they acknowledge that future earnings may not provide any surprises. In this case, it is difficult for the stock price to rise strongly in the near future.

You should always consider the risks.For example, we found 1 Warning Signs of Foxconn Industrial Internet You should know.

You may be able to find a better investment than Foxconn Industrial Internet.If you want to choose possible candidates, check this out free There are some interesting companies trading at low P/E ratios (but have proven they can grow earnings).

Valuation is complex, but we’re helping to make it simple.

see if Foxconn Industrial Internet could be overvalued or undervalued by looking at our comprehensive analysis, which includes Fair value estimates, risks and warnings, dividends, insider trading and financial health.

View free analysis

Have feedback on this article? Follow the content? keep in touch Contact us directly. Alternatively, email the editorial team at (at) simplewallst.com.

This article from Simply Wall St is general in nature. We only use unbiased methodologies to provide commentary based on historical data and analyst forecasts, and our articles are not intended to provide financial advice. It does not constitute a recommendation to buy or sell any stock and does not take into account your objectives or your financial situation. Our goal is to provide you with long-term focused analysis driven by fundamental data. Please note that our analysis may not take into account the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any of the stocks mentioned.