Arab Internet and Communications Services Company (TADAWUL:7202) reported its latest annual results last week, which is a good time for investors to take a closer look at whether the business is performing as expected. 11b St. Regis’ revenue was in line with expectations, although statutory earnings per share (EPS) came in below expectations, at CHF9.93, which was 10.0% below expectations. Analysts typically update their forecasts with each earnings report, and we can tell from their forecasts whether their view of the company has changed or if there are any new concerns to be aware of. We’ve gathered the latest statutory forecasts to see if the analysts have changed their earnings models in light of the results.

Check out our latest analysis for Arab Internet & Communications Services

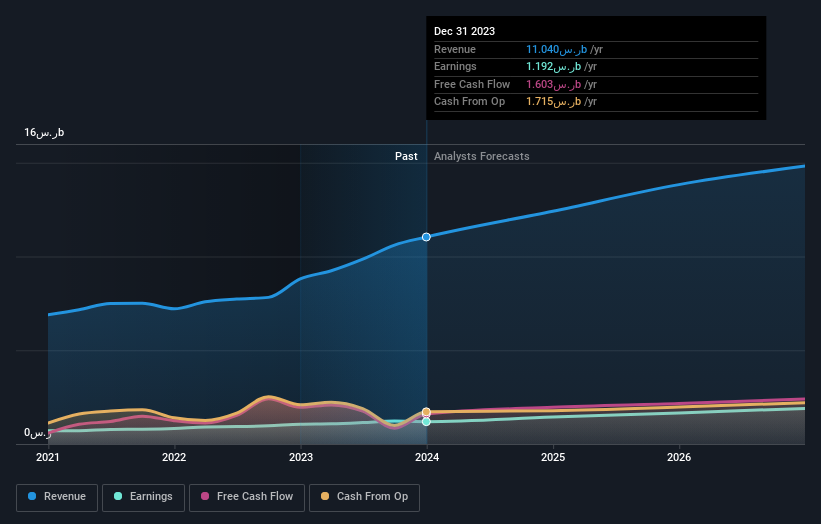

Following the latest results, 13 analysts in the Arab internet and communications services space are now forecasting revenue of ₹12.4b in 2024. If realized, this would reflect a significant 12% improvement in revenue compared to the last 12 months. Earnings per share are expected to rebound 22% to 12.24 euros. Ahead of this report, analysts had been forecasting revenue of ₹12.5b and earnings per share (EPS) of ₹12.73 in 2024. Analysts appear to have become more negative on the business following the latest results, given a small drop in earnings per share next year.

The consensus price target held steady at CHF348, with analysts appearing to vote that their lower forecast earnings are not expected to cause the share price to fall in the foreseeable future. It can also be instructive to look at the range of analyst estimates, to assess how different the outliers differ from the mean. Currently, the most optimistic analyst values Arab Internet and Communications Services at €396 per share, while the most pessimistic prices it at €278. These price targets suggest that analysts do have some differing views on the business, but the differences in estimates aren’t enough for us to think some are betting on massive success or outright failure.

One way to get more context on these forecasts is to see how they compare to both past performance and how other companies in the same industry have performed. We would like to highlight that revenue growth in Arabian Internet and Communications Services is expected to slow, with an annualized growth rate of 12% expected by the end of 2024, well below the historical growth rate of 16% over the past five years. By comparison, other companies in the industry with analyst coverage are expected to see revenue growth of 8.9% annually. So it’s clear that while revenue growth for Arab internet and communications services is expected to slow, it will still grow faster than the industry itself.

bottom line

On top of that, analysts cut their EPS estimates, indicating a clear decline in sentiment following these results. Fortunately, they also reconfirmed their revenue figures, showing that their growth was in line with expectations. Furthermore, our data suggests that revenue is expected to grow faster than the industry as a whole. The consensus price target held steady at €348, with the latest estimates not enough to have an impact on its price target.

Following this line of thinking, we believe the long-term prospects of the business are more important than next year’s earnings. We have forecasts from a number of Arab internet and communications services analysts leading up to 2026, and you can view them for free on our platform.

You can also see our analysis of Arabian Internet and Communications Services’ board and CEO compensation and experience, and whether company insiders have been buying shares.

Valuation is complex, but we’re helping to make it simple.

see if Arab Internet and Communications Services could be overvalued or undervalued by looking at our comprehensive analysis, which includes Fair value estimates, risks and warnings, dividends, insider trading and financial health.

View free analysis

Have feedback on this article? Follow the content? keep in touch Contact us directly. Alternatively, email the editorial team at (at) simplewallst.com.

This article from Simply Wall St is general in nature. We only use unbiased methodologies to provide commentary based on historical data and analyst forecasts, and our articles are not intended to provide financial advice. It does not constitute a recommendation to buy or sell any stock and does not take into account your objectives or your financial situation. Our goal is to provide you with long-term focused analysis driven by fundamental data. Please note that our analysis may not take into account the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any of the stocks mentioned.