Japan Internet Initiative Corporation TSE: 3774) announced that it will pay a dividend of 17.18 yen per share on July 1. This brings the annual payment to 1.2% of the current share price, which unfortunately is less than what the industry pays.

Check out our latest analysis for Japan Internet Initiative

Internet Initiative Japan’s payments have solid profitability

The dividend yield is a bit low, but sustainability of payments is also an important component when evaluating an income stock. However, JII’s earnings easily covered its dividend. This means that most of its revenue will be retained to grow the business.

Next year, earnings per share are expected to grow 68.1%. If the dividend continues on this path, the payout ratio could reach 23% by next year, which we think is quite sustainable going forward.

Japan Internet Initiative has a strong track record

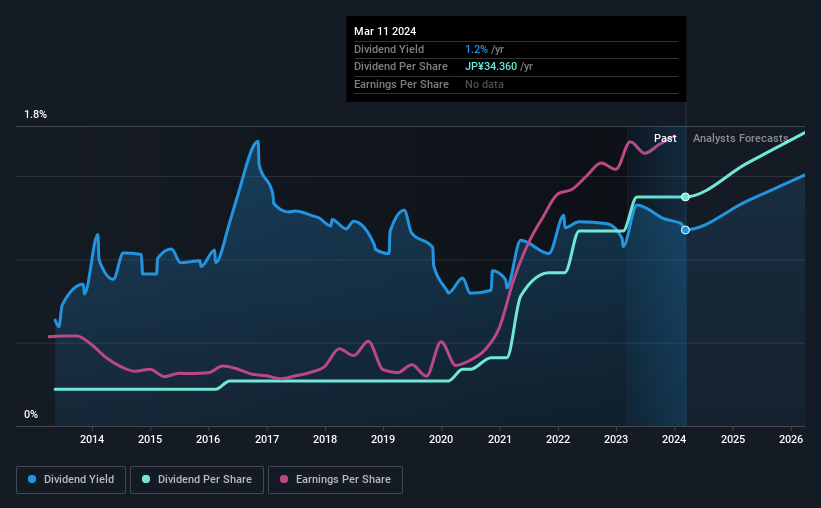

The company has a track record of paying consistent dividends with little volatility. Since 2014, the dividend has increased from 5.50 yen to 34.36 yen per year. This means that its circulation grew at a rate of 20% per year during this period. As a result, dividends have grown quite quickly, and even more impressively, they haven’t experienced any significant declines during this period.

Dividends look likely to grow

Investors in the company will be happy to have been receiving dividend income for some time. We’ve been impressed by Japan Internet Initiative, with earnings per share growing 39% per year over the past five years. Earnings per share are growing steadily and the payout ratio is low, which we think is an ideal combination for a dividend stock since the company can easily increase its dividend in the future.

Japan Internet Initiative looks like a great dividend stock

All in all, it’s always positive to see a dividend increase, and we’re particularly pleased with its overall sustainability. Distributions are easily covered by earnings, which are also converted into cash flow. Taking all of these factors into account, we think this has solid potential as a dividend stock.

Companies with a stable dividend policy are likely to enjoy greater investor interest than those with an inconsistent approach. However, there are other things investors need to consider when analyzing a stock’s performance. Earnings growth often indicates the future value of a company’s dividend payments.See if the 8 Japan Internet Initiative analysts we track predict our continued growth free A report on analyst estimates for the company. Isn’t the Japan Internet Initiative just the opportunity you’re looking for?Why not take a look at our Choose stocks with the highest dividend yields.

Valuation is complex, but we’re helping to make it simple.

see if Japan Internet Initiative could be overvalued or undervalued by looking at our comprehensive analysis, which includes Fair value estimates, risks and warnings, dividends, insider trading and financial health.

View free analysis

Have feedback on this article? Follow the content? keep in touch Contact us directly. Alternatively, email the editorial team at (at) simplewallst.com.

This article from Simply Wall St is general in nature. We only use unbiased methodologies to provide commentary based on historical data and analyst forecasts, and our articles are not intended to provide financial advice. It does not constitute a recommendation to buy or sell any stock and does not take into account your objectives or your financial situation. Our goal is to provide you with long-term focused analysis driven by fundamental data. Please note that our analysis may not take into account the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any of the stocks mentioned.