key insights

- SAKURA Internet’s large retail investor ownership suggests that key decisions are influenced by a broad swath of public shareholders

- The top five shareholders hold 51% of the shares

- Insiders own 22% of SAKURA Internet

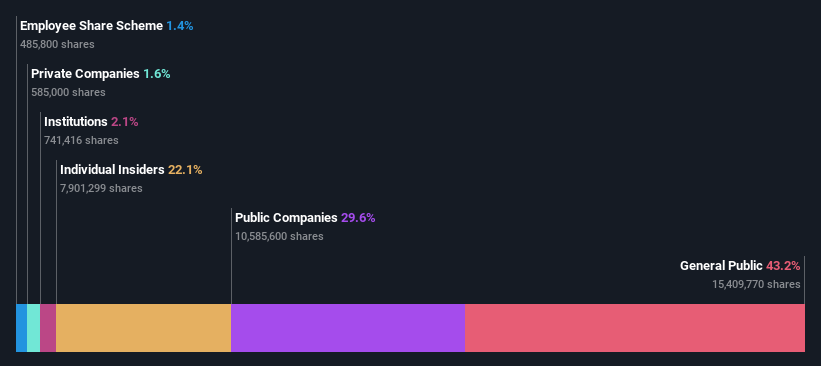

A look at the shareholders of SAKURA Internet Inc. (TSE:3778) can tell you which group is most powerful. Retail investors hold the largest stake in the company, with a shareholding ratio of 43%. In other words, the group will gain the most (or lose the most) from its investment in the company.

Clearly, retail investors benefited the most after the company’s market capitalization rose by ¥19b last week.

Let’s take a deeper look at each type of owner of SAKURA Internet, starting with the chart below.

Check out our latest analysis for SAKURA Internet

What does institutional ownership tell us about SAKURA Internet?

Institutional investors often compare their own returns to the returns of a commonly followed index. Therefore, they will typically consider buying larger companies that are included in the relevant benchmark index.

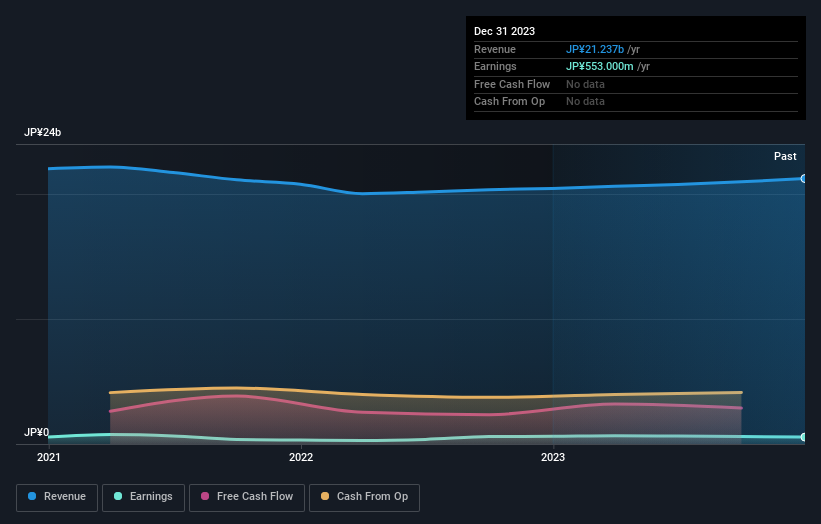

Institutional investors hold less than 5% of SAKURA Internet shares. This shows that some funds have taken a fancy to the company, but many funds have not yet purchased the company’s shares. If the company’s earnings are growing, that could be a sign that it’s just starting to attract the attention of these deep-pocketed investors. When several large institutions want to buy a stock at the same time, we sometimes see the share price rise. The earnings and revenue history, which you can see below, may be helpful in considering whether more institutional investors want to buy the stock. Of course, there are many other factors to consider.

SAKURA Internet is not owned by hedge funds. The company’s largest shareholder is Sojitz Corporation, holding 30% of the shares. Kunihiro Tanaka is the second largest shareholder with 16% of the common stock, and Masaru Washikita owns approximately 3.1% of the company’s stock. The second largest shareholder, Kunihiro Tanaka, also happens to be the CEO.

Our research also revealed the fact that approximately 51% of the company’s shares are controlled by the top 5 shareholders, suggesting that these owners have significant influence over the business.

While it makes sense to study institutional ownership data for a company, it also makes sense to study analyst sentiments to know which way the wind is blowing. Our information suggests that there aren’t any analysts covering the stock, so it’s likely little known.

Internal Ownership of SAKURA Internet

The definition of an insider may vary slightly between different countries, but members of the board of directors always matter. Company management is accountable to the board of directors, which should represent the interests of shareholders. It is important to note that sometimes top managers themselves are board members.

Most consider insider ownership to be a positive because it can indicate the board is well aligned with other shareholders. However, in some cases too much power is concentrated within this group.

Our information suggests that insiders own a significant number of shares in SAKURA Internet Inc. Interestingly enough, insiders own a meaningful ¥5.6bn stake in the ¥25.5bn business. Most would say this shows good alignment with shareholders, especially in a company of this size. You can click here to see if these insiders have been buying or selling.

general public ownership

The public – including retail investors – own 43% of the company, so it can’t be ignored. While this size of ownership may not be enough to influence policy decisions in their favor, they can still have a collective impact on company policy.

Public company ownership

We can see that listed companies hold 30% of SAKURA Internet’s outstanding shares. This may be a strategic interest and the two companies may have related business interests. They may have disbanded. This holding may warrant further investigation.

Next step:

I find it very interesting to know who actually owns a company. But to really gain insight, we need to consider other information.Take adventure as an example – SAKURA Internet has 1 warning sign We think you should know.

certainly, By looking elsewhere, you may find a great investment. So take a look at this free Interesting list of companies.

Note: Figures in this article are calculated using data from the last 12 months, i.e. the 12-month period ending on the last day of the month at the date of the financial statements. This may not be consistent with the full year annual report data.

Valuation is complex, but we’re helping to make it simple.

see if Sakura Network could be overvalued or undervalued by looking at our comprehensive analysis, which includes Fair value estimates, risks and warnings, dividends, insider trading and financial health.

View free analysis

Have feedback on this article? Follow the content? keep in touch Contact us directly. Alternatively, email the editorial team at (at) simplewallst.com.

This article from Simply Wall St is general in nature. We only use unbiased methodologies to provide commentary based on historical data and analyst forecasts, and our articles are not intended to provide financial advice. It does not constitute a recommendation to buy or sell any stock and does not take into account your objectives or your financial situation. Our goal is to provide you with long-term focused analysis driven by fundamental data. Please note that our analysis may not take into account the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any of the stocks mentioned.