You may know, Team Internet Group Co., Ltd. (LON:TIG) recently reported full-year figures. Revenues of US$837m were broadly in line with analysts’ expectations, but statutory earnings per share (EPS) beat forecasts at US$0.086, an impressive 92% above expectations. Following the results, analysts updated their earnings models, and it’ll be good to know whether they think the company’s prospects have changed dramatically, or if it’s business as usual. With this in mind, we’ve gathered the latest statutory forecasts to find out what analysts are expecting for next year.

See our latest analysis for Team Internet Group

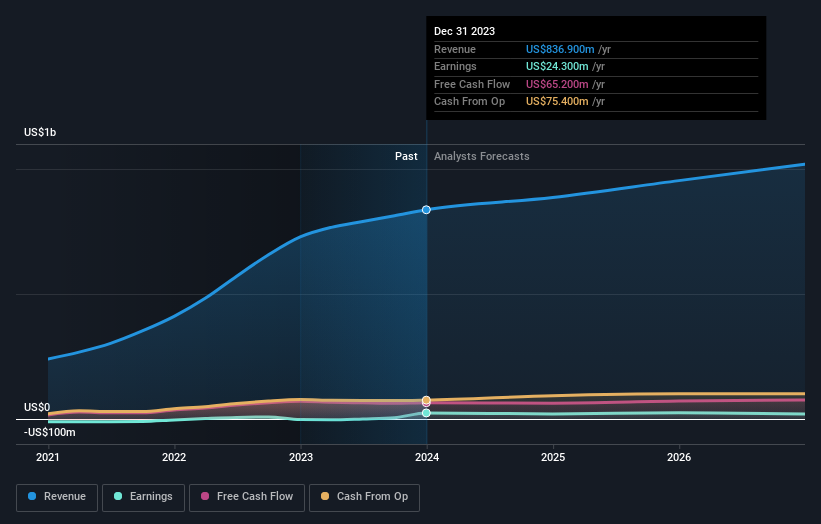

Taking into account the latest results, the latest consensus for Team Internet Group from five analysts is for 2024 revenue of US$886m. If this is achieved, it would mean its revenue would have grown slightly by 5.9% over the last 12 months. Statutory earnings per share are expected to fall 20% to US$0.077 in the same period. However, before the latest earnings release, analysts were expecting revenue of $888.9 million and earnings per share (EPS) of $0.073 in 2024. So the consensus seems to have become more optimistic about Team Internet Group’s earnings potential following these results.

The consensus price target was unchanged at £2.48, meaning the improved earnings outlook is not expected to have a long-term impact on shareholder value creation. However, that’s not the only conclusion we can draw from this data, as some investors also like to consider the difference in estimates when assessing analyst price targets. There are some different views on Team Internet Group, with the most optimistic analyst valuing it at £3.50 per share and the most pessimistic at £1.85 per share. Notice the huge gap in analyst price targets? What this means for us is that there is a fairly wide range of possible scenarios for the underlying business.

These estimates are interesting, but it can be useful to paint some broader outlines when looking at how the forecasts compare to Team Internet Group’s past performance, as well as to peers in the same industry. We would like to highlight that Team Internet Group’s revenue growth is expected to slow down, with an expected annualized growth rate of 5.9% by the end of 2024, well below the historical annual growth rate of 45% over the past five years. By comparison, analysts report that revenue for other companies in the industry is expected to grow by 3.2% annually. So it’s clear that while Team Internet Group’s revenue growth is expected to slow, it will still grow faster than the industry itself.

bottom line

The most important thing here is that analysts upgraded their earnings per share estimates, indicating a clear increase in optimism about Team Internet Group following these results. Happily, there are no major changes to revenue forecasts, with the business still expected to grow faster than the industry as a whole. There have been no real changes to the consensus price target, suggesting that the business’s intrinsic value hasn’t changed in any significant way based on the latest estimates.

That said, the long-term trajectory of the company’s earnings is far more important than next year. We have predictions for the development of Team Internet Group up to 2026, and you can view them for free on our platform.

Don’t forget that risks may still exist.For example, we have determined 2 Warning Signs for Team Internet Group (1 makes us a little uncomfortable) You should be aware.

Valuation is complex, but we’re helping to make it simple.

see if Team Internet Group could be overvalued or undervalued by looking at our comprehensive analysis, which includes Fair value estimates, risks and warnings, dividends, insider trading and financial health.

View free analysis

Have feedback on this article? Follow the content? keep in touch Contact us directly. Alternatively, email the editorial team at (at) simplewallst.com.

This article from Simply Wall St is general in nature. We only use unbiased methodologies to provide commentary based on historical data and analyst forecasts, and our articles are not intended to provide financial advice. It does not constitute a recommendation to buy or sell any stock and does not take into account your objectives or your financial situation. Our goal is to provide you with long-term focused analysis driven by fundamental data. Please note that our analysis may not take into account the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any of the stocks mentioned.