Receiving the trophy from Pied Piper CEO Fran O’Hagan (left) are Polaris vice president of road sales and market development Joel Harmon (center) and Indian Motorcycle vice president Aaron Jax (right).

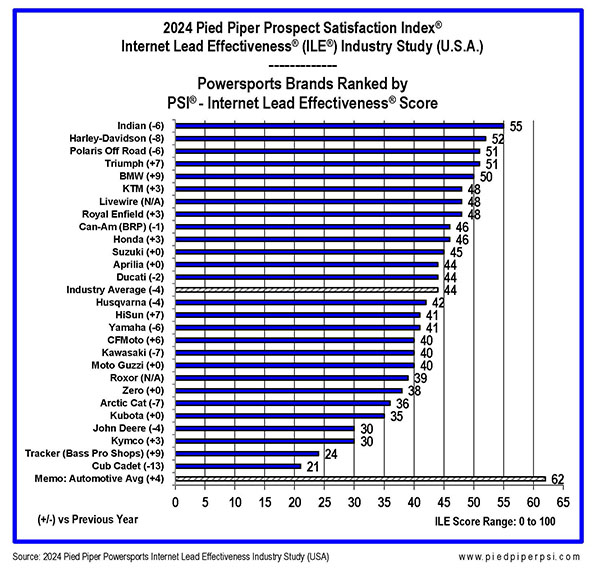

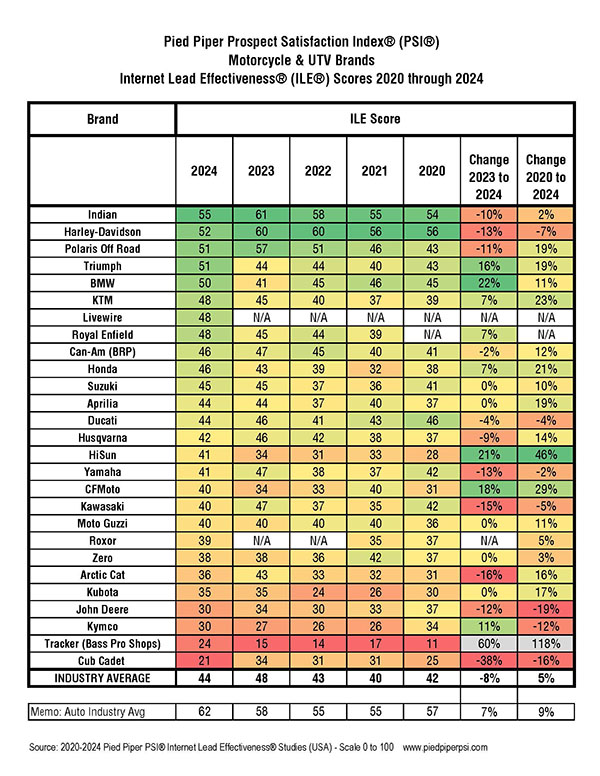

Polaris Corporation Indian motorcycle dealers rank highest according to the 2024 Pied Piper PSI Internet Lead Effectiveness (ILE) study, which measures responsiveness to Internet leads provided by powersports dealer websites. Indiana is followed by Harley-Davidson, Polaris Off-Road, Triumph and BMW.

Pied Piper submitted mystery shopping customer inquiries through various websites of 3,718 Powersports dealers, asking specific questions about the vehicles in stock and providing a unique customer name, email address and local phone number. Pied Piper then assessed how dealers responded via email, phone calls and text messages over the next 24 hours.

The Powersports industry’s average ILE performance has declined over the past year. “2024 is a more challenging business environment for powersports dealers,” said Fran O’Hagan, CEO of Pied Piper. “New digital retail tools and effective cyber response processes will become a key factor in the post-pandemic is becoming more prevalent, but powersports dealers face the challenge of retaining skilled employees to use these tools and processes effectively.”

Twenty different quality and responsiveness measurements produce a dealer ILE score, ranging from 0 to 100. Dealers with scores above 80 provide quick, thorough personal responses via email, phone, and often text messages. In contrast, dealers with scores below 40 were unable to respond personally to their website customers in any way. For the top-scoring Indian Motorcycles, 24% of dealers scored above 80, while 32% scored below 40. By comparison, a measure of the entire powersports industry showed that only 14% of dealers scored above 80, while 43% scored below 40. The effort is worth it,” O’Hagan said. “On average, dealers with scores above 80 sell 50 percent more vehicles to the same number of site customers than dealers with scores below 40 . ”

Brands that improved the most compared to last year include BMW, Triumph, Honda and Royal Enfield. The performance of 11 out of 27 brands declined. Brands with the biggest declines include Kawasaki, Arctic Cat, John Deere, Harley-Davidson and Yamaha.

Dealers this year are slightly more likely to respond to online customer inquiries via text message than in previous years. However, the increase in text messaging usage was offset by reduced performance in other communication channels. Compared to last year, there are fewer quick responses over the phone and fewer emails being used to answer customer questions. Average content quality for dealers across the industry also declined compared to last year, with only 3 of 16 content measures improving on last year’s numbers.

The most successful dealers respond to online customers through multiple channels (text, phone, email) to avoid customers missing an email or text or not answering the phone. In this year’s study, 26% of dealers used multiple channels to respond, down from 27% last year. A small percentage of dealers (15%) not only responded using multiple channels but also responded within 30 minutes, down from 17% last year.

- How often do dealers of this brand respond to website customer inquiries via email?

- On average more than 50% of the time: motoguzzi, india, bmw

- On average less than 25% of the time: Livewire, Kymco, Yamaha, Zero, Tracker

- How often do dealers of this brand respond to inquiries from website customers?

- On average more than 30% of the time: Royal Enfield, Harley-Davidson, Livewire, Triumph, Zero, India

- On average less than 10% of the time: Kubota, John Deere, Kymco, Cub Cadet, Tracker

- How often do dealers of this brand respond to website customer inquiries over the phone?

- On average more than 50% of the time: Tracker, Livewire, Harley-Davidson, Indian, Suzuki, BRP

- On average less than 25% of the time: Roxor, John Deere, Cub Cadet

- “Do both”: How often do dealers of this brand respond to website customer questions via email or text and by phone?

- On average more than 30% of the time: Harley-Davidson, India, Livewire

- On average less than 10% of the time: Toddler Learner, Tracker, Kymco

- “Done at least once”: How often do dealers of this brand respond to website customer questions via email or text message and/or by phone?

- On average more than 80% of the time: Royal Enfield, India, KTM

- On average less than 60% of the time: Kymco, John Deere, Zero, Cub Cadet

“Today, three out of 10 Powersports website customers inquiring about a vehicle are found by a dealer,” O’Hagan said. “Many times, dealers respond today with nothing, or just an automated response, the modern equivalent of a form letter.” Pied Piper has found that the key to driving improved website response, and therefore more sales, is to show dealers their website’s customers Real experience – which is often surprising.

The Pied Piper PSI Internet Leadership Effectiveness (ILE) study has been conducted annually since 2011. The 2024 Pied Piper PSI-ILE Study (USA Powersports) was conducted between May 2023 and February 2024 by submitting website inquiries directly to a nationwide sample of 3,718 dealers representing all major powersports brands.