If you are looking for a multi-bagger, there are a few things you need to pay attention to.Ideally, businesses will exhibit two trends: First, growing return First is capital employed (ROCE), second is growing capital quantity capital employed. This shows us that it is a compounding machine, able to continually reinvest its earnings back into the business and generate higher returns.So when we look at the ROCE trend Arab Internet and Communications Services (TADAWUL:7202), we like what we see.

What is return on capital employed (ROCE)?

For those who aren’t sure what ROCE is, it measures the pre-tax profit a company can generate from the capital employed in its business. The calculation formula for Arab Internet and Communication Services is:

Return on capital employed = Earnings before interest and tax (EBIT) ÷ (Total assets – Current liabilities)

0.32 = SAR1.4b ÷ (SAR12b – SAR7.2b) (Based on trailing 12 months to December 2023).

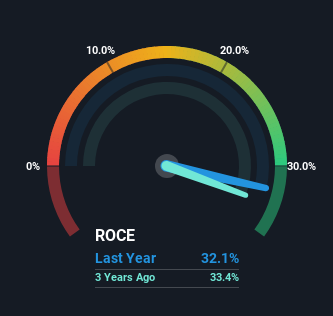

so, Arabian Internet and Communications Services’ ROCE is 32%. On its own, that’s a very good return and comparable to what companies in similar industries have received.

Check out our latest analysis for Arab Internet & Communications Services

Above you can see how Arabian Internet and Communications Services’ current ROCE compares to its previous return on capital, but there’s only so much you can tell from the past.If you’re interested, you can check out our analyst forecasts free Analyst report on Arab Internet and Communications Services.

What can we see from the ROCE trends for Arab Internet and Communications Services?

We are very pleased with capital returns such as Arab Internet and Communications Services. The company has increased its capital by 141% over the past five years, with return on capital holding steady at 32%. With returns so high, it’s great that businesses can keep reinvesting their money at such attractive rates of return. If these trends continue, we wouldn’t be surprised if the company becomes a multi-package company.

On the other hand, Arab Internet and Communications Services’ current liabilities remain quite high, accounting for 62% of total assets. This can come with some risks since the company is basically heavily dependent on its suppliers or other short-term creditors. While this isn’t necessarily a bad thing, it can be beneficial if the ratio is low.

In summary…

Overall, we’re pleased to see Arab Internet & Communications Services compounding returns by reinvesting at consistently high rates of return, as these are common traits among multiple investors. Since the stock has risen strongly over the last year, the market seems to expect this trend to continue. So while investors may consider positive underlying trends, we still think this stock deserves further research.

One more thing to note, we have established 1 warning sign Talk to Arabian Internet and Communications Services and understand that this should be part of your investment process.

High returns are a key factor in strong performance, so check out our free A list of stocks that earn high returns on equity and strong balance sheets.

Valuation is complex, but we’re helping to make it simple.

see if Arab Internet and Communications Services could be overvalued or undervalued by looking at our comprehensive analysis, which includes Fair value estimates, risks and warnings, dividends, insider trading and financial health.

View free analysis

Have feedback on this article? Follow the content? keep in touch Contact us directly. Alternatively, email the editorial team at (at) simplewallst.com.

This article from Simply Wall St is general in nature. We only use unbiased methodologies to provide commentary based on historical data and analyst forecasts, and our articles are not intended to provide financial advice. It does not constitute a recommendation to buy or sell any stock and does not take into account your objectives or your financial situation. Our goal is to provide you with long-term focused analysis driven by fundamental data. Please note that our analysis may not take into account the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any of the stocks mentioned.