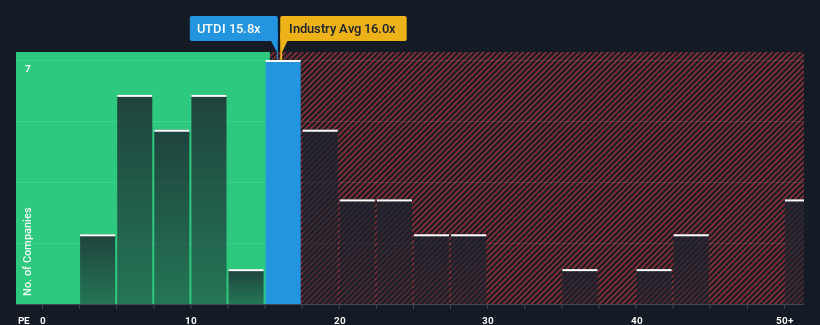

With Germany’s median price-to-earnings (P/E) ratio approaching 17 times, you could be forgiven for feeling apathetic. United Internet Co., Ltd. (ETR:UTDI) has a price-to-earnings ratio of 15.8x. While this may not raise any eyebrows, if the P/E ratio is unreasonable, investors may miss out on potential opportunities or overlook looming disappointment.

The recent period has not been kind to United Internet, as its earnings have declined faster than most other companies. Many may have expected that the dismal earnings performance would soon return to market averages, which kept the P/E ratio from falling. If you still like this company, you’ll want its earnings trajectory to turn around before making any decisions. Or at least, if you’re planning on buying some stock when it’s out of favor, you’ll hope it doesn’t continue to underperform.

Check out our latest analysis for United Internet

Keen to know what analysts think about the future of United Internet and industry competition?In this case, our free Reports are a great place to start.

Is growth consistent with the P/E ratio?

To justify its P/E ratio, United Internet needs to achieve similar growth to the market.

First, to recap, the company’s EPS growth last year wasn’t exciting, as its EPS fell a disappointing 32%. The past three years aren’t looking good either, as the company’s earnings per share shrank a total of 13%. So it’s fair to say that the company’s recent earnings growth hasn’t been great.

Looking ahead, the 12 analysts who cover the company estimate growth of 23% per year over the next three years. With market expectations for annual growth of just 14%, the company is poised for stronger earnings results.

Given this, it’s curious that United Internet’s P/E ratio is in line with most other companies. Apparently, some shareholders are skeptical of this forecast and have been accepting a lower sale price.

The last sentence

While the P/E ratio shouldn’t be the deciding factor in whether you buy a stock, it is a fairly effective barometer of earnings expectations.

Our review of United Internet analyst forecasts shows that its superior earnings outlook does not contribute as much to its P/E ratio as we expected. When we see strong earnings prospects and faster growth than the market, we believe potential risks could put pressure on the P/E ratio. It appears that some do expect earnings to be volatile, as these conditions should typically boost share prices.

Before you make your decision, we found 3 Warning Signs of a Federated Internet You should know this.

If you are interested in P/E ratioyou might want to look at this free A collection of other companies with strong earnings growth and low P/E ratios.

Valuation is complex, but we’re helping to make it simple.

see if United Internet could be overvalued or undervalued by looking at our comprehensive analysis, which includes Fair value estimates, risks and warnings, dividends, insider trading and financial health.

View free analysis

Have feedback on this article? Follow the content? keep in touch Contact us directly. Alternatively, email the editorial team at (at) simplewallst.com.

This article from Simply Wall St is general in nature. We only use unbiased methodologies to provide commentary based on historical data and analyst forecasts, and our articles are not intended to provide financial advice. It does not constitute a recommendation to buy or sell any stock and does not take into account your objectives or your financial situation. Our goal is to provide you with long-term focused analysis driven by fundamental data. Please note that our analysis may not consider the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any of the stocks mentioned.