Nonprofit organizations face unique challenges when managing their assets. With limited resources and competing priorities, it can be difficult to ensure assets are used effectively. This is critical, as the 2023 FORVIS report reveals that more than one in five nonprofits have less than three months of operating cash reserves. However, nonprofits can maximize their impact and achieve their mission by implementing effective asset management strategies.

In this article, we’ll explore the top ten strategies for effective nonprofit asset management. From conducting regular audits to implementing technology solutions, these strategies will help your organization make the most of its assets and improve its financial health.

What is non-profit asset management?

Nonprofit asset management refers to the strategic approach to the acquisition, maintenance, and disposal of the various assets owned or used by nonprofit organizations. These assets can range from tangible assets such as buildings, vehicles, equipment and furniture to intangible assets such as intellectual property, software and data.

Effective asset management ensures that nonprofits have the right assets at the right time, under the right conditions, and at the best cost to support their mission and programs. It involves careful planning, tracking and decision-making throughout the entire asset lifecycle, from acquisition to disposal.

The importance of nonprofit asset management

Effective asset management is critical for nonprofit organizations (NPOs) to fulfill their mission and create lasting impact. Here’s why it’s important:

1. Optimize operations

Effective asset management enables nonprofits to streamline their operations and maximize their resources. By accurately tracking and maintaining assets, organizations can ensure the right equipment, facilities and materials are available when and where they are needed. This minimizes downtime, reduces redundancy, and improves overall efficiency, allowing nonprofits to deliver services and programs more efficiently.

2. Improve financial transparency

Comprehensive asset management practices increase financial transparency within nonprofit organizations. By keeping detailed records of asset acquisition, maintenance, and disposal costs, nonprofits can accurately account for their expenses and provide stakeholders, including donors and regulators, with clear insights into how their resources are being used. This transparency promotes trust and accountability, which are critical to maintaining donor support and maintaining credibility.

3. Improve donor retention rates

When it comes to fundraising, donor retention is critical because retaining donors is five times more cost-effective than recruiting new donors. However, research shows that the average donor retention rate for nonprofits remains around 45%. Donors are more likely to keep donating when they see a clear connection between their contributions and positive outcomes. This is where asset management plays a key role, helping nonprofits build trust with donors, boost their confidence and encourage repeat donations.

4. Enhance decision-making

A good asset management plan can provide nonprofits with the data and insights they need to decide how to allocate assets, which projects to launch, and which strategies to employ.

By analyzing asset performance, usage patterns and life cycle costs, nonprofits can make informed choices about acquisition, replacement and disposal. With this data-driven approach, nonprofits can prioritize their most critical needs and maximize the impact of their investments.

5. Meet regulatory requirements

Non-profit organizations are subject to various regulatory requirements regarding asset management, particularly with regard to financial reporting and compliance with grant or funding regulations. By implementing effective asset management practices, nonprofits can ensure compliance with relevant laws and regulations and be able to provide accurate and complete financial reports to regulators, donors, and stakeholders.

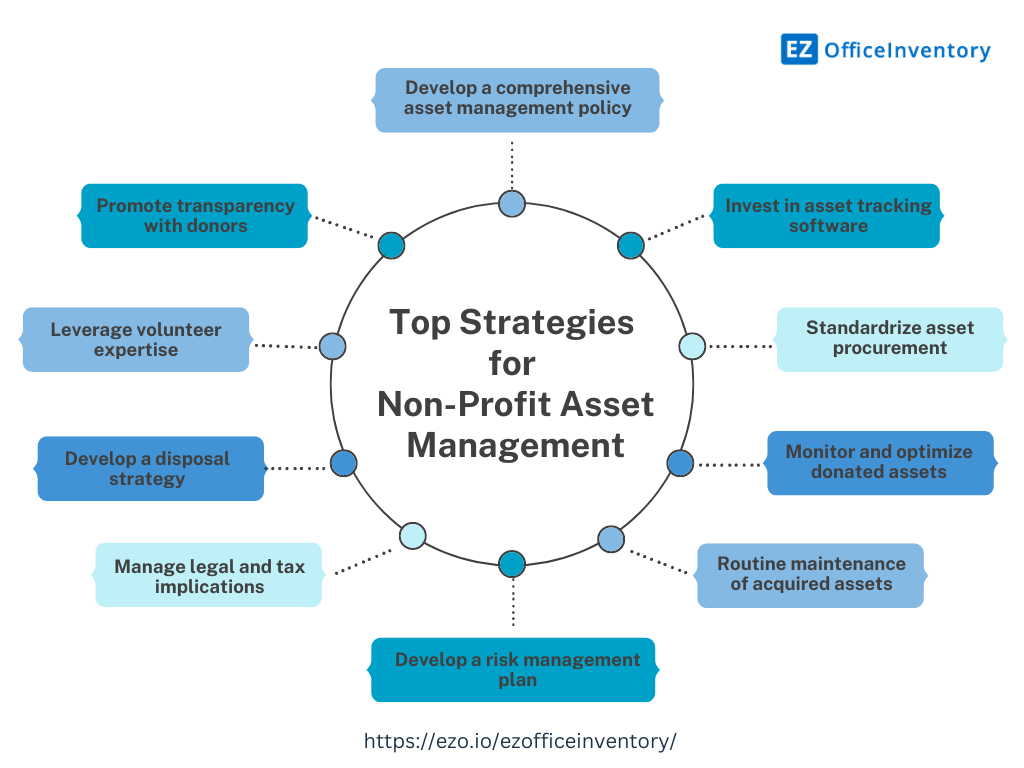

10 Practical Asset Management Strategies for Nonprofit Organizations

Strong nonprofit asset management involves more than just tracking financials. This is a comprehensive approach that ensures optimal use of all resources. Here are 10 practical strategies to get you started:

1. Develop a comprehensive asset management policy

A clear asset management policy is the foundation for effective asset management within a nonprofit organization. The policy should outline clear guidelines for the acquisition, use, maintenance and disposal of the asset. It should also define roles and responsibilities, establish approval processes, and set criteria for determining the optimal asset life cycle.

By developing a clear and concise asset management policy, nonprofits can ensure that all stakeholders are on the same page and assets are managed in a consistent and effective manner.

2. Investment Asset Tracking Software

Nonprofits can revolutionize inventory management by investing in advanced nonprofit asset tracking software that provides real-time information about asset location, condition, and usage. These tools enable nonprofits to reduce the time and resources required for manual asset tracking and increase their overall productivity.

Additionally, such tools can help prevent asset losses, streamline the audit process, and optimize a nonprofit’s asset allocation. Asset tracking software also facilitates efficient reporting and auditing, ensuring compliance with regulatory requirements and donor expectations.

3. Standardize asset procurement

Standardized asset procurement procedures can help nonprofits ensure that the assets they acquire meet their needs and fit within their budgets. This can include establishing formal purchasing processes, setting up approval workflows, and creating standardized templates for purchase orders and invoices.

Standardized procurement practices improve cost-effectiveness, reduce duplication and ensure assets are aligned with an organization’s specific needs and goals.

4. Monitor and optimize donated assets

Asset monitoring and optimization are important components of nonprofit asset management. This includes regular assessments to determine any necessary repairs or upgrades. But it’s not just a matter of fixing it. It is also about ensuring that donated assets are used effectively and in line with the organization’s mission. Does the truck you purchase meet your transportation needs, or is it too large for local deliveries? By taking a holistic approach, nonprofits can ensure they are making the most of these valuable resources.

5. Daily maintenance of acquired assets

The focus of routine maintenance is to prevent problems before they occur. Developing and adhering to a regular maintenance schedule for donated equipment, vehicles and facilities is key. Think about changing the oil in the car you purchased, cleaning your computer filter, or scheduling a building inspection. These practices not only reduce the risk of costly repairs later on, they also ensure assets are operating at optimal levels.

Studies show that preventive maintenance can reduce the frequency of repairs by 25% to 35%. For nonprofits, this means less disruption and smoother operations.

6. Develop a risk management plan

Nonprofits should develop a comprehensive risk management plan to protect their assets from potential threats such as theft, damage, or misuse. One way to manage risk is to use asset tracking software. Using this technology, nonprofits can monitor and manage their assets more efficiently.

With asset management software, nonprofits can maintain detailed records of all their assets, including their location, condition and designated custodian. This level of visibility enables organizations to quickly identify and resolve any discrepancies or irregularities that may arise, reducing the likelihood of assets being lost or mismanaged.

7. Managing legal and tax implications

Managing legal and tax implications is an important aspect of nonprofit asset management. Asset tracking software can be a valuable tool in this regard, helping nonprofits report expenses while ensuring compliance with relevant laws and regulations. These solutions often include the ability to create comprehensive asset registers, track depreciation and maintain records to ensure assets are being used for their intended purpose.

One of the key benefits of nonprofit asset management software is the ability to seamlessly conduct internal audits. For example, EZOfficeInventory maintains detailed logs of asset closings, purchases, and dispositions, allowing nonprofits to easily review and verify transactions. This not only benefits compliance, but also streamlines the audit process and reduces the time and effort required for external audits.

8. Develop a disposal strategy

Developing a disposal strategy can help nonprofits efficiently utilize their assets until the end of their useful life and reduce waste. Asset tracking software can be a valuable tool in this regard, providing features that simplify the disposal process. These solutions often allow assets to be grouped by asset type, enabling accurate depreciation calculations based on each asset class’s unique useful life and depreciation method.

Additionally, fixed asset tracking software can send notifications when an asset is nearing the end of its life cycle, prompting timely decisions about disposal, repurposing, or recycling. This proactive approach ensures that nonprofits can effectively manage their assets and avoid unnecessarily retaining items that are obsolete or damaged beyond repair.

9. Leverage volunteers’ expertise

Volunteers with relevant skills can be a valuable resource for nonprofit asset management tasks, freeing up staff time for core mission activities. By leveraging technology solutions, nonprofits can effectively manage volunteer access and permissions. For example, volunteers with inventory management experience can be granted controlled access to asset tracking software, allowing them to assist with accurate record keeping and updating.

On the other hand, a retired professional with a financial background might be given read-only access to assist with depreciation calculations or disposition decisions without compromising data integrity. With role-based access control and granular permissions, nonprofits can ensure volunteers only interact with specific asset management functions and data relevant to their assigned tasks.

10. Increase donor transparency

It is important to communicate clearly with donors about how their donations will be used, including how donated assets will be managed. By leveraging data-driven insights from modern asset management systems, nonprofits can transparently present data to donors, highlighting the tangible results of their support.

Nonprofits can use Asset Performance Reports to generate detailed consumption and budget reports and share these reports with donors to demonstrate how their asset donations are being used.

Maintain donor satisfaction with nonprofit asset management

Effective nonprofit asset management is critical to the sustainability of any nonprofit organization. By implementing the ten strategies we discuss, nonprofits can earn the trust of donors, reduce costs, and improve the overall financial health of their assets. From developing comprehensive asset management policies to increasing donor transparency, these strategies can help nonprofits make data-driven decisions, build trust with stakeholders, and fulfill their mission.

Thanks for your feedback!