Despite its strong performance, ALiNK Internet Company (TSE:7077) shares have been rising, rising 31% in the past 30 days. The annual gain over the past 30 days reached 53%.

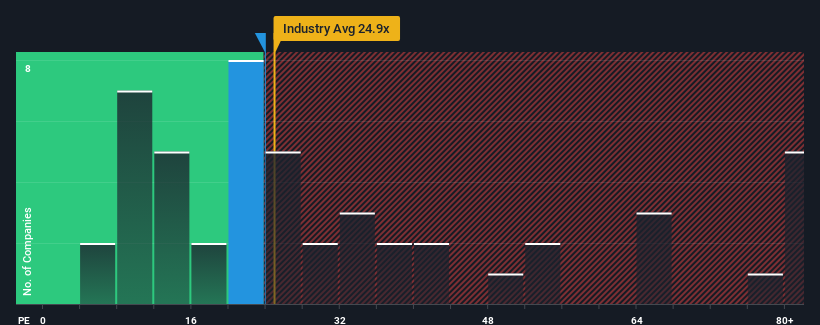

After a significant price increase, ALiNK Internet may be sending out a very pessimistic signal right now with its price-to-earnings (P/E) ratio of 23.9x, as almost half of Japanese companies trade on P/E ratios below 14x, and even P/E ratios below 9x Not uncommon. However, there is a reason why the P/E ratio may be quite high, and further investigation is needed to determine if it is justified.

ALiNK Internet could be doing better, as its earnings have been in retreat of late, while most other companies have seen positive earnings growth. One possibility is that the P/E ratio is high because investors believe poor earnings performance will turn things around. If not, then existing shareholders may be extremely nervous about the viability of the share price.

View our latest analysis for ALiNK Internet

Want a comprehensive look at what analysts are forecasting for the company?then our free ALiNK Internet coverage will help you uncover what’s coming.

What do growth metrics tell us about high P/E ratios?

To justify its P/E ratio, ALiNK Internet would need to deliver superior growth that far outpaces the market.

If we look back at last year’s earnings, the company’s profits were depressingly down by 40%. This means that the company’s earnings have also declined over the longer term, with earnings per share falling a total of 37% over the past three years. As a result, shareholders will be pessimistic about the medium-term earnings growth rate.

Now looking ahead, earnings per share are expected to fall sharply, contracting 18% in the coming year, according to the only analyst who covers the company. Meanwhile, the broader market is expected to grow 11%, which paints a dire picture.

Based on this information, we find that ALiNK Internet has a higher P/E than the market. It seems that most investors are hoping for a turnaround in the company’s business prospects, but the analyst community isn’t that confident. If the P/E ratio falls to a level more consistent with a negative growth outlook, these shareholders will likely be disappointed down the road.

The last sentence

The strong rise in stock prices also caused ALiNK Internet’s price-to-earnings ratio to soar to a new high. While the P/E ratio shouldn’t be the deciding factor in whether you buy a stock, it is a fairly effective barometer of earnings expectations.

We’ve established that ALiNK Internet’s current P/E is well above the expected P/E for a company whose earnings are expected to decline. We’re increasingly uncomfortable with high P/E ratios at the moment, as forecasted future earnings are unlikely to support this positive sentiment over the long term. This exposes shareholders’ investments to significant risks and potential investors are in danger of paying too high a premium.

Before you make your decision, we found 6 Warning Signs for ALiNK Internet (1 involved!) You should be aware of this.

If you are interested in P/E ratioyou might want to look at this free A collection of other companies with strong earnings growth and low P/E ratios.

Valuation is complex, but we’re helping to make it simple.

see if Alec Internet could be overvalued or undervalued by looking at our comprehensive analysis, which includes Fair value estimates, risks and warnings, dividends, insider trading and financial health.

View free analysis

Have feedback on this article? Follow the content? keep in touch Contact us directly. Alternatively, email the editorial team at (at) simplewallst.com.

This article from Simply Wall St is general in nature. We only use unbiased methodologies to provide commentary based on historical data and analyst forecasts, and our articles are not intended to provide financial advice. It does not constitute a recommendation to buy or sell any stock and does not take into account your objectives or your financial situation. Our goal is to provide you with long-term focused analysis driven by fundamental data. Please note that our analysis may not take into account the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any of the stocks mentioned.